Investors searching for exposure to the growing senior housing market often come across National Health Investors. This publicly traded company has built a reputation in the healthcare real estate sector over three decades. But what exactly is this organization, and why does it matter to investors?

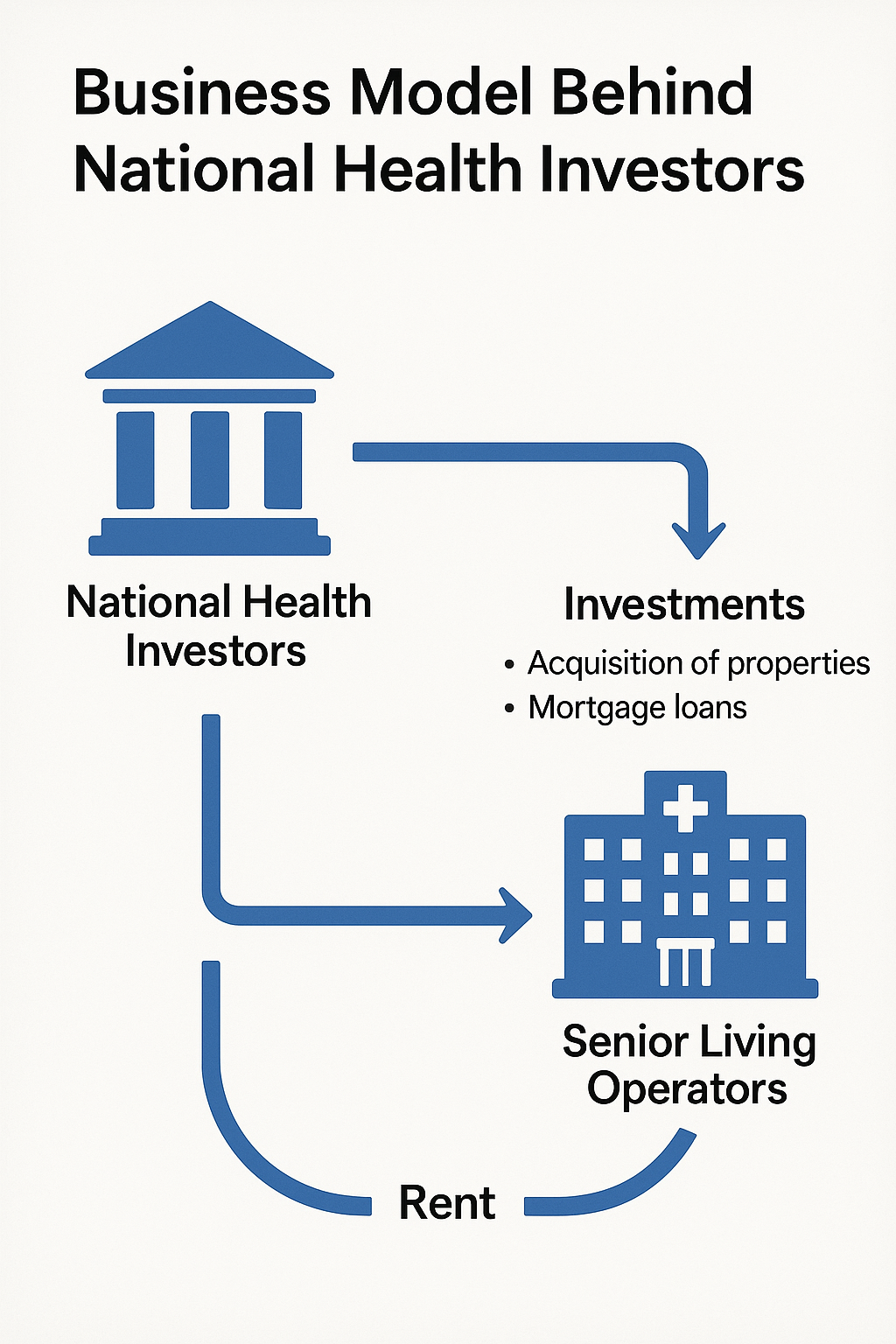

National Health Investors (NYSE: NHI) is a real estate investment trust that owns and finances senior housing and medical facilities across the United States. The company operates by purchasing properties and leasing them to healthcare operators, creating a steady income stream from rental payments.

For those exploring investment opportunities on platforms like Tablon, understanding how healthcare REITs function provides context for evaluating different asset classes and making informed decisions.

The Business Model Behind National Health Investors

National Health Investors operates through a straightforward yet effective model. The company acquires healthcare properties and enters into long-term lease agreements with experienced operators who manage day-to-day operations.

Founded in 1991, National Health Investors specializes in several transaction types. Sale-leaseback arrangements allow healthcare operators to sell their properties to NHI while continuing to operate them under lease agreements. Joint ventures enable the company to partner with operators for shared ownership. Mortgage and mezzanine financing provides capital to healthcare facilities in exchange for interest income.

The company’s portfolio includes independent living facilities, assisted living communities, memory care centers, entrance-fee retirement communities, skilled nursing facilities, and specialty hospitals. This diverse mix helps spread risk across different segments of the healthcare market.

Discover smart investment options with the 10 Best ETFs for Young Investors — please read this blog to find the right picks for your portfolio.

How National Health Investors Generates Revenue

Understanding the revenue model helps clarify what National Health Investors does and how it creates value for shareholders.

The company earns money through three primary channels. Rental income from property leases forms the largest portion, with healthcare operators paying monthly rent to use NHI’s facilities. Interest income from mortgage loans and mezzanine financing adds another revenue layer. For properties the company operates directly through its Senior Housing Operating Portfolio (SHOP), resident fees and services contribute to total income.

According to recent financial reports, National Health Investors generated $335.58 million in revenue during 2024, representing a 4.74% increase from the previous year. This growth reflects both new acquisitions and improved performance from existing properties.

The Senior Housing Operating Portfolio Strategy

National Health Investors has increasingly focused on its SHOP segment, which represents a shift from passive landlord to active operator.

The SHOP model differs from traditional triple-net leases. Instead of simply collecting rent, NHI participates directly in operating certain communities. This approach provides greater control over property performance and captures upside when facilities perform well.

During 2024, the SHOP segment showed notable strength. Occupancy reached 89.4%, while operating margins improved to 23.2%. These numbers represented the strongest performance since 2022, signaling that the strategy is delivering results.

The company plans to continue expanding this segment. Between November 2024 and early 2025, National Health Investors closed $53 million in new investments with an average yield of 9%. Leadership has indicated expectations for continued growth in net operating income from SHOP properties.

Financial Performance and Dividend Track Record

National Health Investors offers investors a combination of income and growth potential through its dividend payments and property appreciation.

The company pays quarterly dividends to shareholders. As of recent reports, the dividend yield stands around 4.8% to 5%, placing it in the higher range among dividend-paying stocks. This yield attracts income-focused investors seeking regular cash flow.

Funds from operations (FFO), a key metric for REITs, increased 3.6% to $4.55 per share in 2024. The company projects 2025 normalized FFO at $4.63 per share, representing continued growth. Funds available for distribution (FAD) is expected to rise 8.6% compared to 2024 guidance.

Total shareholder return reached 30.6% in 2024, outperforming the Nareit Healthcare REIT Index. This performance demonstrates that National Health Investors has delivered value beyond just dividend payments.

For individuals meeting with potential backers through Tablon networking events, understanding these financial metrics provides useful context when discussing REIT investments and portfolio diversification strategies.

The Demographics Driving Growth

What makes National Health Investors particularly interesting is the demographic tailwind supporting its business.

The United States faces a rapidly aging population. Baby boomers continue entering retirement age, increasing demand for senior housing and healthcare services. This trend is expected to accelerate over the next two decades as more people require assisted living, memory care, and skilled nursing services.

Healthcare needs become more acute with age. Facilities in NHI’s portfolio serve populations requiring varying levels of care, from independent living for active seniors to memory care for those with cognitive decline. This spectrum of services positions the company to benefit from multiple aspects of aging demographics.

The trend toward specialized senior housing rather than traditional nursing homes also benefits National Health Investors. Modern seniors and their families increasingly prefer communities that offer lifestyle amenities alongside healthcare services, a model that many properties in NHI’s portfolio embrace.

Risks and Challenges Facing National Health Investors

No investment comes without risks, and National Health Investors faces several challenges that potential investors should understand.

Operator performance remains a persistent concern. Since NHI relies on healthcare operators to run facilities and pay rent, operator financial troubles directly affect the company. Recent reports indicated challenges with Senior Living Management across a four-property portfolio, highlighting this risk. When operators struggle, National Health Investors may need to find replacement operators or take over management, which creates operational and financial complications.

Regulatory changes in healthcare reimbursement affect tenant operators. Since many senior housing facilities receive payments from Medicare, Medicaid, or private insurance, changes to reimbursement rates can impact operators’ ability to pay rent. National Health Investors must monitor these policy shifts and their potential effects on portfolio performance.

Interest rate sensitivity presents another challenge. As a REIT, National Health Investors uses debt to finance acquisitions. Rising interest rates increase borrowing costs and can reduce profit margins on new deals. Higher rates also make dividend-paying stocks less attractive compared to bonds, potentially affecting the stock price.

Competition for quality properties has intensified. As more investors recognize the demographic trends supporting senior housing, competition for well-performing assets has increased. This can drive up acquisition prices and compress yields on new investments.

How National Health Investors compares to Other Healthcare REITs

Positioning National Health Investors within the broader healthcare REIT landscape helps clarify its unique characteristics.

The company focuses specifically on senior housing and medical facilities, unlike diversified healthcare REITs that might also own hospitals, medical office buildings, or life science facilities. This concentration provides clearer exposure to senior housing trends but offers less diversification.

National Health Investors operates at a smaller scale compared to industry giants. This size difference creates both advantages and disadvantages. Smaller size allows for more nimble decision-making and the ability to pursue deals that larger REITs might overlook. However, it also means less access to capital and higher relative costs.

The SHOP strategy differentiates NHI from pure triple-net lease REITs. By directly operating certain properties, the company takes on more operational risk but gains greater control and upside potential. This model requires different management capabilities than passive property ownership.

Learn how Investor Mortgage Financing helps you fund income-generating properties — please read this blog to understand its benefits and process.

Investment Considerations for Potential Shareholders

Those evaluating National Health Investors as a potential investment should consider several factors.

The dividend yield around 5% provides meaningful income for investors seeking cash flow. This yield exceeds many traditional fixed-income investments and blue-chip stocks. However, dividend sustainability depends on continued strong operational performance and tenant stability.

Growth potential stems from both organic improvements at existing properties and new acquisitions. The company has demonstrated ability to source attractive deals, with recent investments averaging 9% yields. Occupancy gains and margin expansion at SHOP properties provide additional growth drivers.

Valuation metrics help assess whether the current stock price offers attractive entry points. As of recent reports, analysts have assigned a “Buy” rating with a 12-month price target representing about 20% upside from current levels. However, past performance and analyst projections don’t guarantee future results.

Portfolio quality matters when evaluating any REIT. National Health Investors has undertaken efforts to improve its portfolio, including disposing of underperforming assets and transitioning troubled properties to stronger operators. These actions indicate active management but also highlight the ongoing nature of portfolio maintenance.

The Role of National Health Investors in a Diversified Portfolio

Understanding how this healthcare REIT fits into broader investment strategies helps clarify its potential role.

Real estate exposure provides diversification benefits. REITs often exhibit different return patterns than stocks or bonds, potentially reducing overall portfolio volatility. Healthcare real estate specifically offers exposure to demographic trends that don’t closely correlate with general economic cycles.

Income generation makes National Health Investors appealing for retirement portfolios or those seeking regular cash flow. The quarterly dividend provides predictable income, though dividend amounts can change based on company performance.

Inflation hedge characteristics exist because rental agreements often include escalators that increase rent over time. This feature helps protect purchasing power during inflationary periods, though the effectiveness varies based on specific lease terms.

For entrepreneurs and investors connecting through Tablon events, discussing how different asset classes complement each other provides valuable conversation topics when exploring investment strategies with potential partners.

Recent Developments and Future Outlook

Staying current with National Health Investors’ recent activities provides insight into the company’s direction.

The company has been active in acquisitions. In late 2024, NHI acquired 10 Spring Arbor communities for $121 million, expanding its portfolio of quality assets. The acquisition of a 109-unit assisted living and memory care community in Colorado for $21.2 million in early 2025 continued this growth trajectory.

Capital markets activity has provided funding for expansion. National Health Investors raised approximately $278.4 million in equity proceeds, with $68.9 million remaining available as of early 2025. The company also successfully extended over $200 million in term loan maturities into 2026.

Leadership changes and governance improvements have addressed investor concerns. The board added four new members over four years and committed to removing the classified board structure. These changes respond to shareholder feedback and demonstrate responsiveness to governance best practices.

Looking forward, National Health Investors projects continued growth. The 2025 guidance suggests 4.3% FFO growth and 8.6% FAD growth. Management expects elevated net operating income growth in the SHOP segment to drive performance.

Tablon: Connecting Investors with Opportunities

While National Health Investors operates in healthcare real estate, investors exploring various opportunities can benefit from networking and education resources.

Tablon provides a community for connecting with investors and founders in the UAE and surrounding regions. The platform hosts monthly networking dinners where early-stage businesses can meet potential backers in focused settings. For those seeking more targeted discussions, one-on-one meetings allow detailed conversations about specific investment opportunities.

Understanding established investment vehicles like National Health Investors helps inform broader investment strategy discussions. Whether you’re raising capital for a new venture or seeking to deploy capital across various asset classes, knowledge of different sectors and structures enhances decision-making.

Tablon community brings together entrepreneurs and investors who value meaningful connections over transactional relationships. This approach aligns with the long-term perspective that successful investing requires, whether in REITs, startups, or other opportunities.

Key Takeaways About National Health Investors

To summarize what National Health Investors represents and why it matters:

- National Health Investors is a specialized healthcare REIT focusing on senior housing and medical facilities. The company has operated since 1991, building a portfolio of properties leased to healthcare operators. Recent strategic shifts toward the SHOP model indicate evolution beyond passive landlord status.

- The investment thesis rests on demographic trends supporting long-term demand for senior housing. An aging population creates a sustained need for the services provided at NHI’s properties. This demand provides fundamental support for the business model.

- Financial performance has shown resilience with growing FFO, improving SHOP margins, and strong total shareholder returns in recent periods. The dividend yield around 5% offers income potential for investors seeking cash flow.

- Risks include operator performance issues, regulatory changes, interest rate sensitivity, and acquisition competition. These factors require ongoing monitoring and management.

- For investors exploring different asset classes or entrepreneurs discussing funding strategies at Tablon networking events, understanding how established investment vehicles function provides valuable context. National Health Investors exemplifies how real estate investment trusts operate within specialized healthcare sectors, offering lessons applicable to various investment discussions.

Frequently Asked Questions

What type of company is National Health Investors?

National Health Investors is a real estate investment trust (REIT) that specializes in owning and financing senior housing and medical facilities. The company purchases healthcare properties and leases them to operators, generating income from rental payments and interest on financing. NHI trades on the New York Stock Exchange under the ticker symbol NHI and has operated since 1991.

How does National Health Investors make money?

The company generates revenue through three main channels. Rental income from leased properties forms the largest portion, with healthcare operators paying monthly rent. Interest income comes from mortgage loans and mezzanine financing provided to healthcare facilities. For properties operated through the Senior Housing Operating Portfolio, resident fees and services contribute additional revenue. This diversified income model helps stabilize cash flow across different market conditions.

What is the dividend yield for National Health Investors?

National Health Investors currently offers a dividend yield around 4.8% to 5%, placing it among higher-yielding dividend stocks. The company pays dividends quarterly to shareholders. Recent quarterly payments have been approximately $0.90 to $0.92 per share. Dividend amounts can fluctuate based on company performance, and past payments don’t guarantee future distributions. Income-focused investors often find this yield attractive for portfolio cash flow.

What properties does National Health Investors own?

The portfolio includes various types of senior housing and healthcare facilities across the United States. Independent living communities serve active seniors who want amenities and services. Assisted living facilities provide help with daily activities. Memory care centers specialize in caring for individuals with cognitive decline. Entrance-fee retirement communities offer continuing care options. The portfolio also includes skilled nursing facilities and specialty hospitals, creating exposure across the senior housing spectrum.

What risks should investors consider with National Health Investors?

Several factors create risk for investors. Operator financial troubles can disrupt rental income if tenants struggle to pay. Regulatory changes affecting healthcare reimbursement may impact tenant operators’ profitability. Interest rate increases raise borrowing costs and can make dividend stocks less attractive. Competition for quality properties can compress yields on new acquisitions. Additionally, the concentrated focus on senior housing means less diversification compared to broader REITs. Investors should assess these factors against their risk tolerance and investment goals.