The entrepreneurial journey is filled with countless challenges, but perhaps none is more critical than securing the right funding to fuel your business growth. Understanding the landscape of different types of investors in business can be the difference between your startup’s success and failure. Whether you’re a first-time entrepreneur or a seasoned business owner looking to scale, knowing which investor aligns with your company’s stage, vision, and values is crucial for long-term success.

In today’s dynamic business environment, the relationship between entrepreneurs and investors has evolved significantly. It’s no longer just about securing capital; it’s about finding the right partner who can provide strategic guidance, industry connections, and expertise that complement your business objectives. This comprehensive guide will explore the various types of investors available to entrepreneurs, their unique characteristics, and how to effectively engage with each category.

Understanding the Investment Ecosystem

Before diving into specific investor types, it’s essential to understand that the investment ecosystem is diverse and multifaceted. Each type of investor brings different expectations, investment horizons, and levels of involvement to the table. The key to successful Finding Investor for Startup lies in identifying which investor type best matches your business stage, industry, and growth trajectory.

The modern investment landscape includes traditional sources like banks and venture capitalists, as well as newer forms such as crowdfunding platforms and impact investors. Each category serves different purposes and caters to various business needs, making it crucial for entrepreneurs to understand these distinctions when developing their funding strategy.

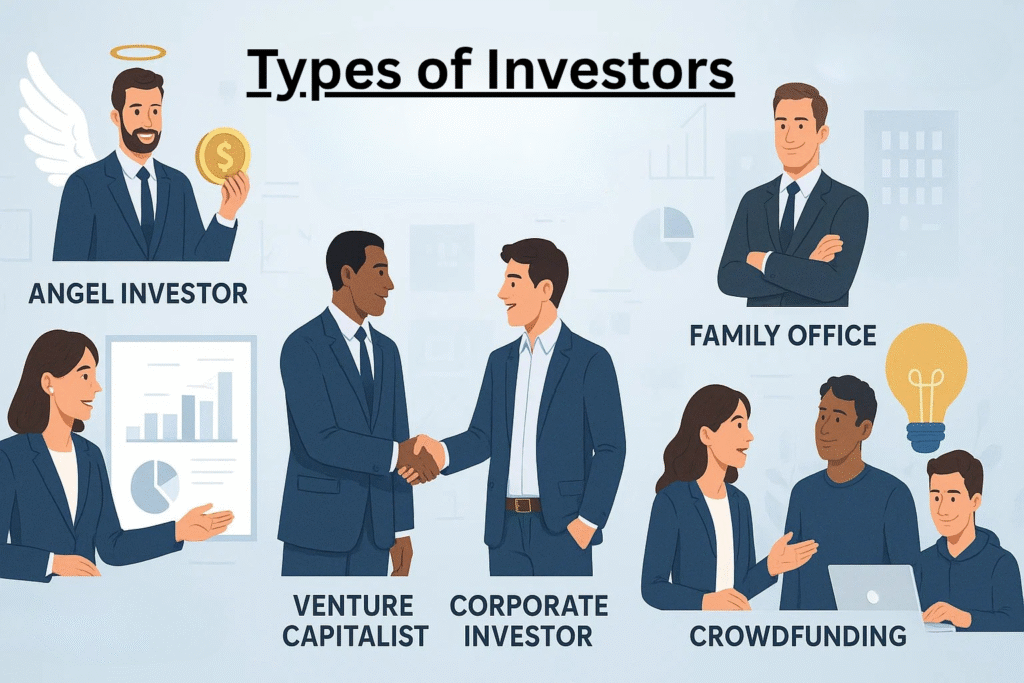

- Angel Investors: The First Believers

Angel investors represent one of the most accessible and entrepreneur-friendly investor categories for early-stage businesses. These high-net-worth individuals typically invest their personal funds in startups, often in exchange for equity or convertible debt. What sets angel investors apart is their willingness to take risks on unproven concepts and their ability to provide mentorship alongside capital.

Angel investors are particularly valuable during the seed stage when businesses are still validating their concept and building their initial customer base. They often invest amounts ranging from $10,000 to $100,000, though some may invest significantly more depending on their wealth and interest in the venture. The relationship with angel investors often extends beyond financial support, as many bring valuable industry experience, networks, and strategic guidance.

Investor for Startup opportunities, angel investors can be found through various channels including angel investor networks, startup events, and online platforms. Building relationships with angel investors requires a compelling pitch that demonstrates market opportunity, team capability, and a clear path to profitability. Many successful startups credit their angel investors not just for the capital provided, but for the credibility and connections that helped them secure subsequent funding rounds.

- Venture Capitalists: Scaling for Growth

Venture capitalists (VCs) represent institutional investors who manage pooled funds from various sources, including pension funds, endowments, and wealthy individuals. Unlike angel investors, VCs typically invest larger amounts and are more focused on businesses that can scale rapidly and generate significant returns. Their involvement usually begins after a company has demonstrated initial traction and is ready to scale operations.

The venture capital landscape includes different stages of funding, from seed-stage VCs who invest in very early companies to growth-stage VCs who focus on established businesses ready for expansion. Each stage comes with different expectations regarding business maturity, revenue generation, and market validation. VCs typically invest amounts ranging from hundreds of thousands to millions of dollars, making them suitable for businesses with substantial capital requirements.

What makes venture capitalists particularly attractive is their expertise in scaling businesses and their extensive networks within the startup ecosystem. They often provide strategic guidance on everything from product development to market expansion, and their portfolio companies benefit from cross-pollination of ideas and resources. However, securing VC funding is highly competitive, with only a small percentage of businesses receiving investment from top-tier firms.

- Private Equity Firms: Established Business Partners

Private equity firms focus on investing in established businesses with proven track records and stable cash flows. Unlike venture capitalists who primarily target startups, private equity investors typically acquire controlling stakes in mature companies with the goal of improving operations, expanding markets, or restructuring for enhanced profitability.

These investors bring significant capital and operational expertise to businesses, often implementing strategic changes to drive growth and efficiency. Private equity investments are typically much larger than VC investments, ranging from millions to billions of dollars. The investment horizon is usually longer, with private equity firms holding investments for several years before seeking an exit through sale or public offering.

For business owners considering private equity investment, it’s important to understand that these investors often seek controlling interests and may implement significant operational changes. However, they also bring valuable resources including experienced management teams, strategic guidance, and access to additional capital for expansion initiatives.

- Crowdfunding Platforms: Democratizing Investment

The rise of crowdfunding has revolutionized how entrepreneurs can access capital by allowing them to raise funds from a large number of individual investors. Crowdfunding platforms have democratized the investment process, enabling businesses to validate their concepts while raising capital from supporters who believe in their vision.

There are several types of crowdfunding, including reward-based crowdfunding where backers receive products or services in return for their investment, and equity crowdfunding where investors receive ownership stakes in the company. Each type serves different purposes and attracts different types of backers, from customers who want early access to products to investors seeking financial returns.

Crowdfunding success requires effective marketing, compelling storytelling, and strong community engagement. Businesses that succeed in crowdfunding often have products with broad appeal, clear value propositions, and founders who can effectively communicate their vision to potential backers. While crowdfunding can provide access to capital without giving up significant equity, it also requires significant time and effort to manage campaigns and fulfill commitments to backers.

- Strategic Investors: Industry Partnerships

Strategic investors are typically established companies that invest in startups or smaller businesses within their industry or related sectors. These investors are motivated not just by financial returns but by strategic benefits such as access to new technologies, market expansion opportunities, or competitive advantages.

Strategic investors can provide unique value beyond capital, including access to distribution channels, customer bases, technical expertise, and industry relationships. They often have deep understanding of market dynamics and can provide valuable guidance on product development, go-to-market strategies, and scaling operations within their industry.

However, strategic investors may also present potential conflicts of interest, particularly if they compete in similar markets or have relationships with competitors. Entrepreneurs considering strategic investors should carefully evaluate the potential benefits and risks, ensuring that the partnership aligns with their long-term strategic objectives.

- Government and Institutional Investors

Government agencies and institutional investors represent another important category in the investment ecosystem. Government programs often provide funding for businesses in specific sectors such as clean technology, healthcare, or defense, while institutional investors like pension funds and insurance companies may invest in businesses that align with their long-term investment strategies.

These investors often have specific mandates or criteria that businesses must meet to qualify for funding. Government investors may focus on businesses that create jobs, promote economic development, or address social challenges. Institutional investors typically seek stable, long-term returns and may be particularly interested in businesses with predictable cash flows and established market positions.

- Navigating Investor Relationships

Successfully working with investors requires understanding not just what they bring to the table, but also what they expect in return. Different types of investors & roles for startups come with varying levels of involvement, expectations for returns, and timelines for exit. Some investors prefer hands-off approaches, while others want to be actively involved in strategic decisions and operations.

Building strong investor relationships starts with clear communication about expectations, regular updates on business progress, and transparency about challenges and opportunities. Successful entrepreneurs understand that investors are partners in their journey and work to maintain these relationships even after initial funding rounds are complete.

What Investors Seek in Founders

Understanding what Investors Look for in Founders Startups is crucial for entrepreneurs seeking funding. Investors typically evaluate founders based on several key criteria including industry expertise, leadership capability, and track record of execution. They want to see founders who demonstrate deep understanding of their market, clear vision for their business, and the ability to execute on their plans.

Investors also look for founders who are coachable and open to feedback, as the relationship between investors and entrepreneurs is often collaborative. They want to see evidence of strong problem-solving skills, resilience in the face of challenges, and the ability to attract and retain talented team members. Many investors also value founders who have skin in the game and are fully committed to their venture.

The team dynamic is another critical factor that investors look for in startups. Investors prefer teams with complementary skills, shared vision, and proven ability to work together effectively. They want to see that founders have thoughtfully considered their team composition and have strategies for filling skill gaps as the business grows.

Mastering the Art of Investor Pitching

Knowing what to Make While Pitching Investors can significantly impact your success in securing funding. A compelling pitch should clearly articulate the problem you’re solving, your unique solution, and the market opportunity. Investors want to understand not just what you’re building, but why it matters and how you plan to capture value in the market.

Your pitch should demonstrate thorough market research, competitive analysis, and realistic financial projections. Investors appreciate founders who understand their competitive landscape and can articulate their differentiation strategy. They also want to see evidence of customer validation and traction, even if the business is still in early stages.

When preparing what to Pitching Investors, focus on storytelling that connects emotionally while providing concrete data to support your claims. Practice your pitch extensively and be prepared to answer detailed questions about your business model, financial projections, and growth strategy. Remember that investors are not just evaluating your business; they’re evaluating you as a founder and leader.

The Role of Investor Dinners and Networking

Investor Dinners for Startups and networking events play a crucial role in building relationships within the investment community. These gatherings provide opportunities for entrepreneurs to meet potential investors in more casual settings, allowing for deeper conversations about business vision, market opportunities, and personal connections.

Successful networking at Investor Dinners for Startups requires preparation and strategic thinking. Research attendees in advance, prepare thoughtful questions about their investment focus and portfolio companies, and be ready to discuss your business in various formats from elevator pitches to detailed conversations. Remember that these events are about building relationships, not just securing immediate funding.

The value of dinners for startups extends beyond individual meetings to include learning from other entrepreneurs, understanding market trends, and gaining insights into investor perspectives. Many successful funding relationships begin with casual conversations at networking events that develop into more formal discussions over time.

Sector-Specific Investors

Many investors specialize in specific industries or sectors, bringing deep expertise and networks that can be particularly valuable for businesses in those areas. Healthcare investors understand regulatory requirements and clinical trial processes, while technology investors may have expertise in software development, cybersecurity, or artificial intelligence.

Sector-specific investors often provide more than just capital; they bring industry connections, regulatory knowledge, and strategic guidance that can accelerate business development. They may also have relationships with potential customers, partners, and acquisition targets within their focus sectors.

When seeking sector-specific investors, entrepreneurs should research the investor’s portfolio companies, investment thesis, and industry focus. Understanding an investor’s specific expertise and interests can help entrepreneurs tailor their approach and demonstrate alignment with the investor’s strategic objectives.

International and Cross-Border Investing

As businesses increasingly operate in global markets, international investors have become an important part of the funding landscape. These investors may bring access to new markets, international networks, and cross-border expertise that can help businesses expand beyond their home countries.

International investors often have different cultural perspectives, regulatory knowledge, and market insights that can be valuable for businesses looking to scale globally. However, working with international investors may also involve additional complexity related to currency exchange, legal structures, and cultural differences.

Impact and ESG Investors

Environmental, Social, and Governance (ESG) investing has gained significant momentum, with investors increasingly focusing on businesses that generate positive social and environmental impact alongside financial returns. Impact investors seek businesses that address social challenges, promote sustainability, or contribute to positive change in their communities.

These investors often have specific criteria related to impact measurement, sustainability practices, and social responsibility. They may provide patient capital and longer investment horizons for businesses that demonstrate strong impact potential alongside financial viability.

Preparing for Investor Due Diligence

Once you’ve identified potential investors and generated initial interest, preparing for due diligence becomes critical. Investors will conduct thorough reviews of your business including financial records, legal documents, market analysis, and competitive positioning. Being prepared for this process can significantly accelerate funding timelines.

Key areas of due diligence include financial performance and projections, legal structure and compliance, intellectual property protection, and market opportunity validation. Having organized documentation and clear explanations for key business decisions can help build investor confidence and streamline the funding process.

How MyTablon Helps You Connect with the Right Investors

At MyTablon, we don’t just offer insights—we help you find the right investors faster:

- Curated Investor Matchmaking

- Investor Dinners for Startups

- Community Access to 100+ Active Investors

- Workshops & Pitch Training

Whether you’re building in education, SaaS, fintech, or consumer products, we connect you with investors who care about your space.

Conclusion: Building Your Investor Strategy

Successfully navigating the diverse landscape of investors requires strategic thinking, thorough preparation, and clear understanding of your business needs and growth objectives. Each type of investor brings unique advantages and considerations, making it essential to align your funding strategy with your business stage, industry, and long-term vision.

The key to successful fundraising lies not just in securing capital, but in building relationships with investors who can provide strategic value beyond financial resources. Whether you’re seeking angel investors for early-stage funding, venture capitalists for scaling operations, or strategic investors for industry partnerships, understanding what each type brings to the table will help you make informed decisions about your funding strategy.

Remember that the investor relationship is a long-term partnership that extends well beyond the initial funding transaction. Choosing the right investors who align with your values, vision, and growth objectives can provide the foundation for sustainable business success and long-term value creation.

As you embark on your fundraising journey, take time to research potential investors thoroughly, prepare compelling materials that clearly articulate your value proposition, and approach the process with patience and persistence. The right investor partnership can transform your business trajectory and provide the resources, expertise, and support needed to achieve your entrepreneurial vision.

Frequently Asked Questions

1. What are the main types of investors in business?

The most common types of investors include angel investors, venture capitalists, corporate investors, family offices, and crowdfunding backers. Each plays a different role depending on your startup’s stage, industry, and funding needs.

2. How can I start finding investors for startup ideas?

Start by building a strong pitch deck, researching relevant investors in your sector, and joining platforms like My Tablon, which help founders find the right investors quickly and connect through tools like Investor Dinners for Startups.

3. What do investors look for in founders before investing?

Investors typically look for leadership skills, market understanding, vision, resilience, and the ability to execute. Having a clear growth plan and knowing your finances also plays a huge role in getting funded.

4. How can I avoid mistakes while pitching to investors?

Avoid vague answers, inflated projections, or not knowing your business model. Many startups make mistakes while pitching investors by focusing too much on features and not enough on value, market, and traction.

5. What role does My Tablon play in connecting startups with investors?

My Tablon helps founders find startup investors, join a vetted investor network, and pitch effectively through curated events and strategic resources. It bridges the gap between innovative startups and capital-ready investors.