Did you know that 90% of tech startups fail, with insufficient funding being one of the primary reasons? Finding the right investors can be the difference between your innovative idea becoming the next unicorn or joining the graveyard of failed ventures. For tech entrepreneurs, securing investment isn’t just about money—it’s about finding partners who understand your vision and can provide the expertise needed to scale your business.

The journey to find investors for your tech startup may seem daunting, but with the right strategies and understanding of the investment landscape, you can connect with the right funding partners who align with your goals and growth trajectory.

Understanding the Investment Landscape for Tech Startups

Before diving into how to find investors for tech startup ventures, it’s crucial to understand the different types of investors available and what they’re looking for. The investment ecosystem is diverse, ranging from angel investors and venture capitalists to crowdfunding platforms and government grants.

Angel investors are typically high-net-worth individuals who invest their personal funds in early-stage companies. They often provide not just capital but also mentorship and industry connections. Venture capitalists, on the other hand, manage pooled money from various sources and typically invest larger amounts in companies with proven traction and scalable business models.

Understanding where your startup fits in this ecosystem will help you target the right type of investors and tailor your approach accordingly. Early-stage tech startups often benefit from angel investors who can provide both funding and guidance, while more established companies might be better suited for venture capital funding.

Building a Strong Foundation Before Seeking Investment

Successful fundraising starts long before you pitch to investors. Your tech startup needs a solid foundation that demonstrates market potential, technical feasibility, and business viability.

Start by developing a minimum viable product (MVP) that showcases your core value proposition. Investors want to see that you can execute your vision and that there’s market demand for your solution. Gather user feedback, track key metrics, and document your learning process.

Create a compelling business plan that outlines your market opportunity, competitive landscape, revenue model, and growth strategy. Include detailed financial projections and demonstrate how you’ll use the investment to achieve specific milestones.

Your team is equally important. Investors invest in people as much as they invest in ideas. Ensure your founding team has the right mix of technical expertise, business acumen, and industry knowledge. If you’re missing key skills, consider bringing on advisors or co-founders who can fill those gaps.

Networking and Building Relationships in the Tech Community

The most successful founders understand that fundraising is fundamentally about building relationships. Start networking within the tech community long before you need funding. Attend industry events, join startup accelerators, and participate in pitch competitions.

Consider joining specialized networking platforms that connect founders with investors. Tablon helps you find startup investors fast by connecting with 100+ investors online and joining their active investors community to get funding for your startup growth. Such platforms provide structured environments where you can meet potential investors and build meaningful connections.

Engage with the startup ecosystem in your region. Many cities have thriving tech communities with regular meetups, co-working spaces, and networking events. Building relationships with other entrepreneurs can lead to valuable introductions and referrals to investors.

Don’t overlook the power of online communities. Social media platforms like LinkedIn and Twitter can be powerful tools for connecting with investors and showcasing your expertise. Share insights about your industry, comment on relevant posts, and engage in meaningful conversations.

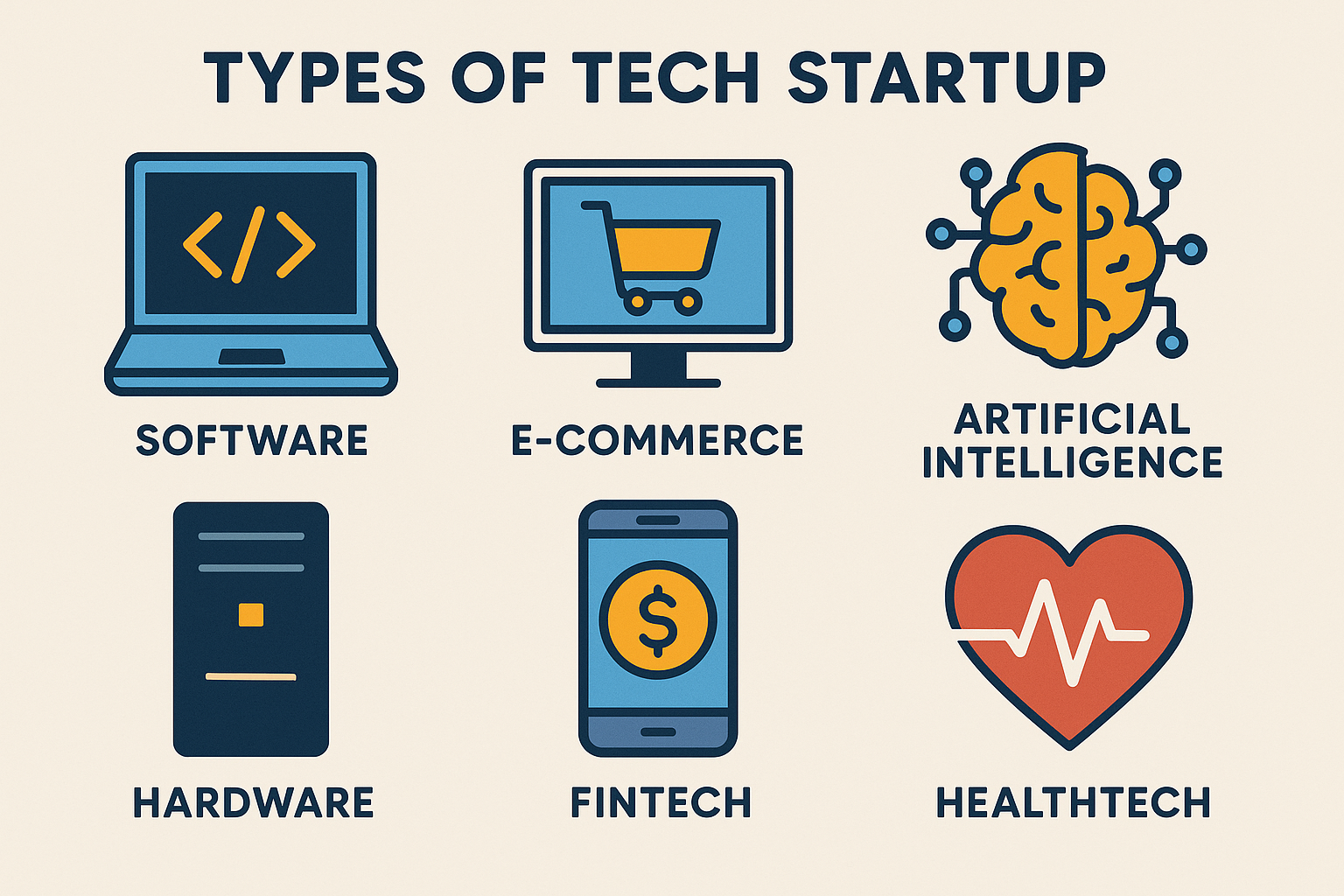

Types of Tech Startups

Software as a Service (SaaS)

Companies delivering software via the cloud on a subscription basis. Examples: Slack, Salesforce.

Fintech

Startups that innovate in financial services, from payments to investing. Examples: Stripe, Robinhood.

Health Tech

Solutions for healthcare delivery, diagnostics, wellness, and patient management. Examples: Teladoc, Headspace.

E-commerce

Online platforms for buying and selling products. Examples: Shopify, Etsy.

Artificial Intelligence & Machine Learning

Startups building AI-driven products or services. Examples: OpenAI, DeepMind.

EdTech

Technology to improve education and learning experiences. Examples: Coursera, Duolingo.

PropTech

Innovations in real estate, property management, and leasing. Examples: Zillow, Opendoor.

Cybersecurity

Startups offering tools to protect data and systems. Examples: CrowdStrike, Okta.

Blockchain & Crypto

Decentralized apps, exchanges, or blockchain infrastructure. Examples: Coinbase, Chainlink.

Clean Tech

Companies focused on sustainable energy, waste reduction, and green innovation. Examples: Tesla, ChargePoint.

Marketplace Platforms

Connecting buyers and sellers of goods or services. Examples: Uber, Airbnb.

Hardware & IoT

Building physical devices with smart, connected features. Examples: Nest, Fitbit.

Leveraging Online Platforms and Investment Networks

The digital age has democratized access to investors through various online platforms and networks. These platforms can significantly expand your reach and help you connect with investors who might not be accessible through traditional networking.

Equity crowdfunding platforms allow you to raise capital from a large number of smaller investors. While the individual investment amounts may be smaller, these platforms can provide valuable market validation and create a community of supporters around your brand.

Many regions have developed online investor networks that facilitate connections between startups and investors. These platforms often provide tools for pitch deck sharing, due diligence, and communication throughout the funding process.

Professional networking platforms have become increasingly important for startup fundraising. Maintain an active presence on LinkedIn, regularly share updates about your company’s progress, and use the platform to research and connect with potential investors.

Crafting the Perfect Pitch and Presentation

Your pitch is your opportunity to make a strong first impression and communicate your vision effectively. A compelling pitch deck should tell the story of your startup while addressing the key concerns investors have.

Start with a clear problem statement that resonates with your audience. Explain why this problem matters and who it affects. Present your solution in a way that clearly demonstrates how it addresses the problem better than existing alternatives.

Include market size and opportunity data to show the potential scale of your business. Investors want to see that you’re pursuing a large enough market to generate significant returns. Provide details about your target customers and how you plan to reach them.

Demonstrate traction and progress. Show key metrics, customer testimonials, partnerships, or other evidence that validates your business model. This is particularly important for tech startups, where investors need to see that your technology works and that there’s market demand.

Present your business model clearly, including how you make money, your pricing strategy, and your path to profitability. Include realistic financial projections that show how you’ll use the investment to achieve growth milestones.

Utilizing Professional Networks and Warm Introductions

Cold outreach to investors rarely yields positive results. The most successful fundraising efforts rely on warm introductions through mutual connections. Leverage your professional network to identify potential pathways to investors.

Start by mapping out your network and identifying anyone who might have connections to investors. This includes mentors, advisors, other entrepreneurs, lawyers, accountants, and industry professionals. Don’t hesitate to ask for introductions—most people are willing to help if you approach them respectfully.

Consider working with professional service providers who regularly interact with investors. Law firms, accounting firms, and investment banks often have extensive networks and can provide valuable introductions if they believe in your business.

Industry events and conferences can provide opportunities for organic introductions. Research who will be attending and identify potential investors you’d like to meet. Prepare a brief elevator pitch and be ready to follow up with more detailed information.

Exploring Regional Investment Opportunities

Different regions offer unique investment opportunities and ecosystems. Understanding the local investment landscape can help you identify the best opportunities for your tech startup.

Many governments offer grants, tax incentives, and investment programs specifically designed to support tech startups. Research what’s available in your region and ensure you meet the eligibility criteria. These programs often provide non-dilutive funding, meaning you don’t have to give up equity in your company.

Regional investor networks and venture capital firms often have a preference for local companies. They understand the local market dynamics and can provide valuable connections within the ecosystem. Research investors in your region and understand their investment criteria and portfolio companies.

Consider the benefits of specialized networks in key business hubs. Tablon B2B Network connects investors and founders looking to raise $2M or less through in-person networking events and exclusive 1-on-1 meetings for investors and founders. Such focused approaches can be particularly effective for early-stage startups.

Due Diligence and Investor Vetting

Finding investors is only half the battle—you also need to ensure they’re the right fit for your startup. Not all money is good money, and the wrong investor can actually harm your business.

Research potential investors thoroughly. Look at their portfolio companies, investment history, and reputation in the industry. Talk to other entrepreneurs who have worked with them to understand their approach and how they support their portfolio companies.

Understand the terms being offered. Don’t just focus on the valuation—consider the liquidation preferences, board composition, anti-dilution provisions, and other terms that could impact your control and future fundraising efforts.

Consider the value-add beyond capital. Great investors bring expertise, connections, and guidance that can accelerate your growth. Evaluate whether potential investors have relevant experience in your industry and can provide strategic value.

Building Long-term Investor Relationships

Successful fundraising is about building long-term relationships, not just securing a single round of funding. Most tech startups will need multiple rounds of funding as they grow, so maintaining strong relationships with investors is crucial.

Keep investors updated on your progress even after you’ve secured funding. Regular updates help maintain engagement and can lead to follow-on investments or introductions to other investors. Be transparent about both successes and challenges.

Leverage your investors’ networks and expertise. Don’t hesitate to ask for introductions to potential customers, partners, or employees. Most investors are willing to help their portfolio companies succeed.

Consider the long-term implications of your investor relationships. These partnerships can last for many years and significantly impact your company’s trajectory. Choose investors who share your vision and values.

Conclusion

Finding investors for your tech startup is a challenging but essential part of building a successful business. Success requires a combination of preparation, networking, persistence, and strategic thinking. Remember that fundraising is fundamentally about building relationships, communicating your vision effectively, and understanding how to find investors online to expand your reach and opportunities.

Start by building a strong foundation for your startup, including a compelling product, solid business plan, and experienced team. Leverage both online platforms and offline networking to connect with potential investors. Craft a compelling pitch that clearly communicates your value proposition and market opportunity.

The investment landscape offers numerous opportunities for tech startups, from angel investors and venture capitalists to crowdfunding platforms and government programs. By understanding the different options available and targeting the right type of investors for your stage and industry, you can significantly improve your chances of securing the funding you need.

For founders looking to connect with investors in the Middle East region, consider joining specialized networking platforms that facilitate these connections. The right networking approach can open doors to valuable funding opportunities and long-term partnerships that will help your tech startup achieve its full potential.

Ready to take the next step in your fundraising journey? Start building those crucial investor relationships today and turn your tech startup vision into reality.

Frequently Asked Questions

Q1: How much equity should I give to investors in my tech startup?

Equity percentages vary based on funding stage, amount raised, and company valuation. Early-stage startups typically give 10-25% equity for seed funding, while later stages may involve smaller percentages as valuations increase.

Q2: What’s the typical timeline for raising investment for a tech startup?

The fundraising process typically takes 3-6 months from initial preparation to closing. This includes building relationships, preparing materials, pitching to investors, due diligence, and negotiating terms.

Q3: Should I approach multiple investors simultaneously or one at a time?

Approach multiple investors simultaneously to create momentum and competitive dynamics. However, prioritize quality over quantity and ensure you can manage multiple conversations effectively while maintaining personalized communications.

Q4: What documents do I need to prepare before approaching investors?

Essential documents include a pitch deck, business plan, financial projections, market analysis, legal documents, and executive summary. Having these materials ready demonstrates professionalism and preparedness.

Q5: How do I know if an investor is legitimate and trustworthy?

Research their track record, speak with other entrepreneurs they’ve funded, check their online presence and reputation, and verify their credentials through industry networks and professional associations.