Introduction

Investors and funding are two inseparable concepts in the financial world. Whether you are a startup founder looking for seed money or an established business seeking a large investment round, the two main sources of funding that you are likely to come across are individual investors and institutional investors.

These are the primary investor types in the venture capital (VC) and private equity (PE) landscape, and each serves a distinct function.

Individual investors refer to private people who invest their personal wealth in other people’s businesses and projects. Institutional investors, on the other hand, are organizations that pool funds from a group of investors to invest at a higher level.

Both individual investors and institutional investors are a crucial part of the global economy, but they do not come without their advantages and disadvantages. In this comprehensive guide, we will take an in-depth look at the differences between individual and institutional investors and weigh the pros and cons of each to determine which may be the right fit for your funding needs.

What is an Individual Investor?

An individual investor, also known as a retail investor, is a private individual who invests their own money in various financial assets, such as stocks, bonds, mutual funds, real estate, or private businesses.

Unlike institutional investors, individual investors for businesses do not manage other people’s money. They make their investment decisions based on their own personal financial goals, risk appetite, and available capital.

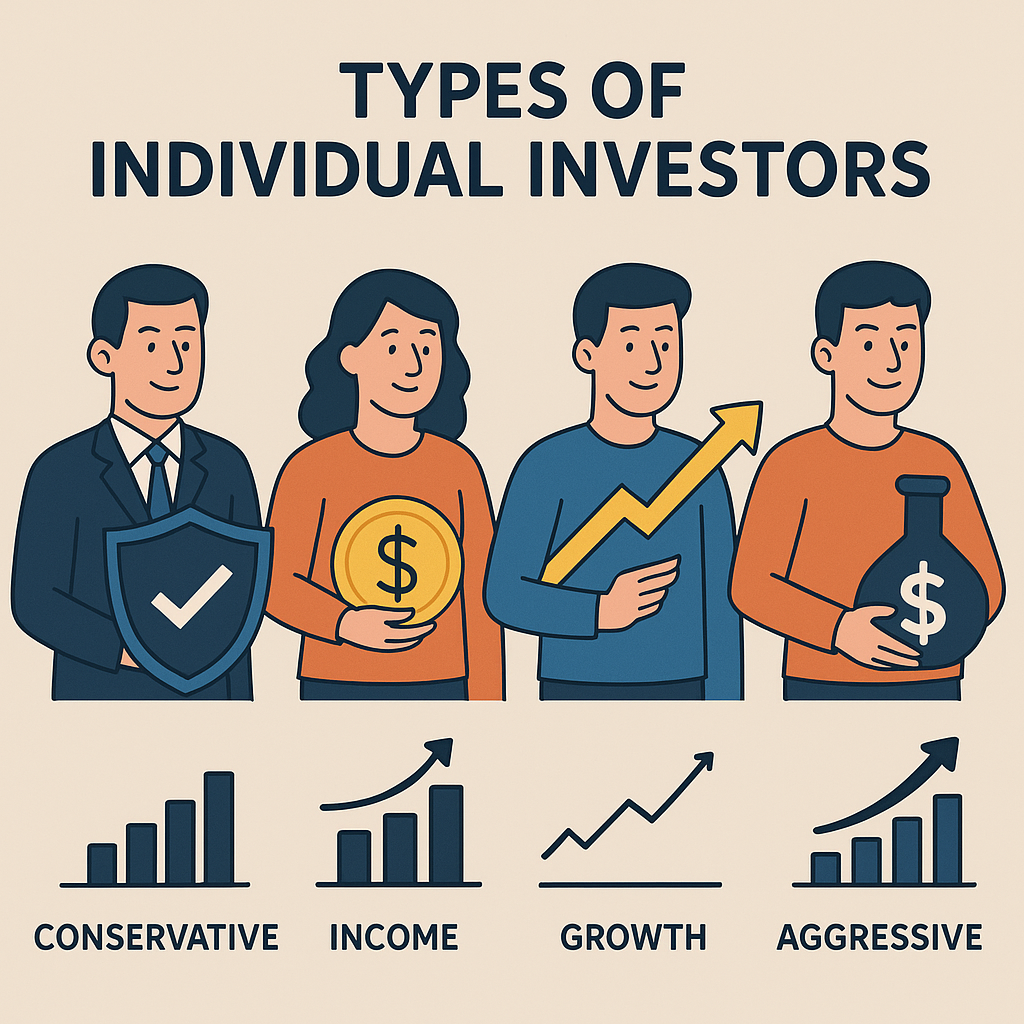

Types of Individual Investors

- Retail Investors – Ordinary people who buy shares or bonds through a brokerage account.

- High-Net-Worth Individuals (HNWIs) – Individuals with a high level of investable assets, typically over $1 million.

- Angel Investors – Wealthy individuals who provide capital to startup companies in exchange for an equity stake.

- Self-Directed Investors – Individuals who take a DIY approach to managing their own investment portfolios with little or no assistance from financial advisors.

Characteristics of Individual Investors

- Are typically more flexible and agile in their investment decisions.

- Can invest in unconventional or niche investment opportunities.

- Are often influenced by personal beliefs, values, or interests.

- Have a more personal relationship with their investments.

What is an Institutional Investor?

An institutional investor is an organization or entity that invests large sums of money on behalf of others. These entities can include pension funds, insurance companies, mutual funds, hedge funds, and investment banks.

Institutional investors typically manage money for pensioners, insurance policyholders, or clients of an investment firm or bank. They also have the resources to participate in investment opportunities that are typically out of reach for individual investors. Institutional investors also have a large impact on the market due to their massive investing power.

Types of Institutional Investors

- Pension Funds – Manage retirement savings for workers.

- Insurance Companies – Invest the premiums collected from policyholders.

- Mutual Funds & ETFs – Pool money from a group of investors to buy a diversified portfolio of securities. ETFs trade like stocks on exchanges.

- Hedge Funds – Use various strategies to maximize returns for investors.

- Sovereign Wealth Funds – State-owned investment vehicles that manage a country’s reserves.

Characteristics of Institutional Investors

- Invest large amounts of money in a wide range of assets.

- Have significant negotiating power.

- Are highly regulated and subject to strict compliance requirements.

- Have access to professional research and analysis.

Key Differences Between Individual and Institutional Investors

| Aspect | Individual Investor | Institutional Investor |

| Capital Size | Limited to personal wealth | Billions in managed assets |

| Decision-Making | Quick, flexible, based on personal judgment | Structured, slower, requires multiple approvals |

| Risk Appetite | Often willing to take higher risks in niche areas | Risk-managed, often more conservative overall |

| Market Impact | Minimal influence on market prices | Can move markets with large trades |

| Access to Deals | Limited to public or small private deals | Access to exclusive, large-scale opportunities |

Advantages of Individual Investors

- Flexibility – Can make decisions quickly without complex approvals.

- Personalized Relationships – More hands-on, with a personal interest in the businesses they invest in.

- Early-Stage Funding – Willing to invest in companies without a proven track record.

- Aligned Interests – May share the founder’s vision and provide mentorship.

Advantages of Institutional Investors

- Large Capital Access – Can provide millions or billions in funding.

- Credibility – Adds legitimacy and attracts other investors.

- Professional Management – Teams of analysts and financial experts.

- Long-Term Stability – Longer investment horizons and ongoing support.

Disadvantages of Individual Investors

- Limited capital compared to institutions.

- Higher personal risk since they invest their own money.

- Potential lack of diversification.

Impact on Startups & Early-Stage Businesses

Startups may find individual investors (especially angel investors) more accessible in the early stages, as they are more open to new ideas.

Institutional investors generally wait until a business has proven itself with revenue and growth before investing.

The Role of Networking in Connecting Investors and Founders

Networking is one of the most effective ways to source funding through investment events, industry meetups, or investor dinners.

Platforms like Tablon enable founders to:

- Download free investor listings by country.

- Attend curated investor dinners.

These opportunities foster real-life connections between investors and founders.

How to Choose Between an Individual and Institutional Investor

- Early-stage → Choose individual or angel investors.

- Large-scale funding needs → Institutional investors are better.

- Value mentorship & flexibility → Individual investors are preferable.

- Need credibility & partnerships → Institutional investors can deliver.

Trends in the Investment Landscape

- Angel Networks – Groups of individuals pooling funds to invest.

- Institutional Interest in Startups – More early-stage institutional involvement.

- Hybrid Models – Deals involving both individual and institutional investors.

Case Study 1: Individual to Institutional Path

A SaaS startup raised $150,000 from three angel investors to build its MVP. After reaching 10,000 users in 12 months, it secured $5 million from a venture capital fund to scale globally.

Case Study 2: Institutional Entry in Early Stage

A deep-tech startup raised seed capital from a government-backed innovation fund, gaining credibility and substantial resources from the start.

Conclusion

Individual investors and institutional investors are both vital in the investment ecosystem.

- Individual investors provide agility, passion, and early-stage funding.

- Institutional investors offer large-scale capital, credibility, and strategic partnerships.

For entrepreneurs, the choice depends on the stage of the business and funding needs. Often, a combination of both works best starting with individuals and moving to institutions later.

Networking platforms like Tablon help bridge this journey by connecting early-stage founders with angel investors in real life, providing not just funding opportunities but also the chance to build meaningful, long-term relationships.

FAQs About Individual vs. Institutional Investors

Q1: Can an individual investor invest like an institutional investor?

Yes, in terms of strategy, an individual investor can follow similar principles — such as diversification, research-based decisions, and long-term planning. However, they usually can’t match the scale, resources, or access that institutional investors enjoy.

Q2: Do institutional investors fund early-stage businesses?

It’s rare, but possible. Most institutional investors prefer companies with proven business models, revenue growth, and lower risk. However, some venture capital firms, government-backed funds, and corporate innovation arms do invest in early-stage startups.

Q3: Which is better for startups — individual or institutional investors?

There’s no universal answer. Early-stage businesses often benefit more from individual investors due to their flexibility and willingness to take risks. Later-stage businesses usually benefit more from institutional investors due to their capacity for large-scale funding and resources.

Q4: What is the main difference in decision-making between individual and institutional investors?

Individual investors can decide quickly based on personal judgment. Institutional investors often require multiple layers of approval, formal due diligence, and committee decisions, which can slow down the process.

Q5: Are individual investors regulated like institutions?

Not to the same extent. Institutional investors operate under strict regulatory frameworks due to the large sums they manage on behalf of others. Individual investors follow general securities laws but have fewer compliance obligations.

Q6: Can individual investors invest in institutional-grade opportunities?

Sometimes. While many large deals are closed to individuals, angel investors and accredited investors can access certain private equity, hedge fund, or real estate deals if they meet the financial and legal requirements.